Home, a place where you live together with your close and loved ones, may mean the whole world to you. You always wanted to make your home a better place to live, giving all comforts to your family. You can do this just by making improvements in your home, but where to get the funds for it. Home Improvement Loan is the solution to your problem.

Home Improvement Loan is a loan that is granted to borrowers to make changes or improvements in their homes. A home improvement loan is good if you don’t want to use your savings or don’t have sufficient savings for the home improvement project.

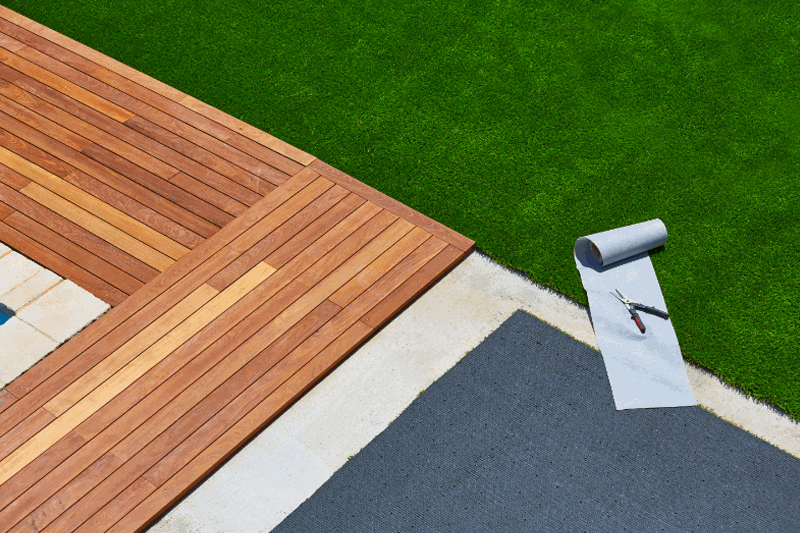

Home Improvement Loans can be used to purchase fitted bedroom furniture or to develop unused spaces in your home. You can use Home Improvement Loan for improving your garden such as landscaping. Home Improvement Loan is also available for double-glazing, new conservatory, heating system, new kitchen, rewiring, and plumbing, or any home remodeling that you can think of. Making improvements in your home helps in improving your lifestyle as well as may add value to your home.

Home Improvement Loans can be classified as secured and unsecured Home Improvement loans. A Secured Home Improvement Loan is a loan secured by a borrower’s collateral such as a house, car, or bonds. You can borrow any amount between ¥5,000 to ¥75,000 A Secured Home Improvement Loan can be repaid at any term between 5 to 25 years depending on the income available to you and the amount of equity in the property kept as a security with the lender. You can get Home Improvement Loan up to 125% of property value. A secured loan offers flexible repayment options with a low rate of interest.

An unsecured Home Improvement Loan is a loan that requires no collateral to be kept as a security with the lender. The rate of interest on the loan is higher compared to that of a secured loan, as there is no security attached to this loan.

You can get a Home Improvement Loan from banks and financial institutions. Now, you can also get a Home Improvement Loan online. You can collect loan quotes from various lenders which are available free of cost. Make a comparison among the various quotes and shortlist the few you find suitable. Try to find out more details about the short-listed loan options and choose the one that you find the best. But don’t be haste, relax and shop around and make some efforts. Your efforts will definitely repay you in the future by saving your money.

You can also tie your home improvement loan into the existing mortgage package, which will benefit you with a lower rate of interest and help in releasing the money you needed for the home improvement project.

You can get a secured Home Improvement Loan even if you have a bad credit rating, poor credit history, CCJs, defaults, or arrears. Your bad credit history can’t stop you from making desired improvements in your home. You can avail a bad credit home improvement loan that is designed especially for you.

Home Improvement Loan is a loan granted for making changes or improvements in the home such as a new kitchen or decoration. It helps in making your home a better place to live for your whole family. A home Improvement loan may help add value to your home by the significant improvements you intend to make. When searching for a home improvement loan, Shop around and compare the quotes of various lenders, these efforts will help you find the best deal.

Want to discuss more? Contact our remodeling consultant now.